To borrow a line from my favorite songwriter and performer, Neil Diamond, aviation is “headed for the future and the future is now.” If you’ve ever been in the market for an airplane, 2008 is a banner year to buy.

To borrow a line from my favorite songwriter and performer, Neil Diamond, aviation is “headed for the future and the future is now.” If you’ve ever been in the market for an airplane, 2008 is a banner year to buy.

Everything is in place, and all at the same time. We have the most favorable financing terms that we’ve had in the last three years. Recently, Congress gave the President a new tax law with incentives that he signed on February 13, 2008. There are now two types of tax incentives: ones that apply only to the purchase of new airplanes, and incentives that apply to the purchase of new and used airplanes. These tax incentives expire on December 31, 2008.

While researching this article, I spoke with several aircraft manufacturer representatives. Of course, they were paying close attention to the tax bill as it was going through, and they’re geared up and ready to meet what they now expect to be a strong demand for new aircraft. All of the reps asserted that for new airplanes with price tags of $1 million and under, they’re prepared to meet the consumers’ needs and deliver in 2008. As existing aircraft owners trade in and trade up, the used-aircraft market should also flourish with the financing and tax incentives that are now available. I’ll admit that when I was talking with the reps, the wheels were turning in my mind about the feasibility of making a change in 2008.

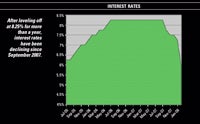

According to The Wall Street Journal, the prime interest rate in July 2005 was 6.25%. The prime rate started a steady upward climb and reached 8.25% in July 2006, where it leveled off and remained for over a year. Since September 2007, the prime interest rate has been on a downward journey and is presently at or below the rates of almost three years ago.

By looking at the interest rates, you can tell that banks are sitting on a lot of money they would love to loan out. The last thing a bank wants is a low loan portfolio because it doesn’t make a lot of money on uninvested funds that are just sitting in its vault. Therefore, if your finances are in good shape and your debt ratios are good, you’re a prime candidate for borrowing money at perhaps the best rates in three years.

I’m willing to bet that the majority of aircraft owners justify their ownership based on business purposes. As such, they’re entitled to claim a tax deduction on the portion of aircraft expenses that relate to a business purpose. It’s not unusual for federal and state taxes to add up to 35% or more, so tax management is just as critical as expense management. When you think about the IRS allowing a 35% tax savings, which makes the out-of-pocket cost only 65 cents on the dollar, you can see how important tax incentives and tax savings are to aviation.

With the passage of the Economic Stimulus Act of 2008, aviation was a beneficiary of an extraordinary tax incentive. In my 30 years as a practicing CPA, I’ve only seen these kind of tax incentives one other time, and that was a few years ago in 2003 when we had the 30% and 50% bonus depreciation on new aircraft. It was a fantastic time for aviation, and a lot of new airplanes came into existence.

Guess what: Bonus depreciation is back. Lately, the press has been talking about the rebate checks that will start being mailed out in May 2008. But buried in the new law are tax incentives for businesses to invest in new machinery and aircraft, so that the companies can make money and pay tax to support the rebate checks. And that’s what the Economic Stimulus Act of 2008 is all about. The government is willing to make an investment today for a return on the investment tomorrow. With interest rates behaving the way they have recently, the timing of the Economic Stimulus Act’s passage just couldn’t have been more auspicious.

|

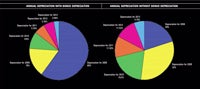

| With bonus depreciation (above, left), annual depreciation for 2008 is 60%. Without bonus depreciation (above, right), annual depreciation for 2008 is 20%. |

Take a minute to look at the effect on depreciation deductions with and without the bonus depreciation. For discussion purposes, there are exceptions that will change the numbers depending on when in 2008 you actually acquire your aircraft. These are referred to as the mid-quarter rules. With those differences noted, however, without the 50% bonus depreciation, the first-year depreciation is 20% of the cost. If you equate this 20% to a 35% tax rate, the depreciation deduction in 2008 will reduce your income taxes by about 7% of the airplane’s cost. For example, if the airplane cost $500,000, then you can expect to reduce your tax bite by $35,000.

Now, let’s take a look at how the recently passed 50% bonus depreciation can affect 2008. With the bonus depreciation, the first-year depreciation is raised to 60% of the cost. Again, if you equate this 60% to a 35% tax rate, the depreciation deduction will cut your tax bite by 21% of the airplane’s cost. Following the same example of a $500,000 airplane, this will save $105,000 of income tax. Think about this, if your down payment is 20% ($100,000), the IRS has just reduced your 2008 taxes by enough money to make the down payment and put $5,000 in your pocket. Now for the catch—with a couple of exceptions, bonus depreciation only applies to new aircraft bought and placed in service in 2008.

Now don’t give up on me just yet. Remember when I said there were also incentives for used airplanes? Well here we go with updated Section 179 deduction amounts for 2008. Unlike the bonus depreciation, the Section 179 depreciation deduction applies to new or used equipment and airplanes. The updated 2008 amounts permit the taxpayer to write off up to $250,000 of the cost of the airplane purchased in 2008 as long as the total cost of all equipment purchased by the business in 2008 doesn’t exceed $800,000. There’s also the added criteria that the Section 179 deduction is limited to income; therefore, unlike the bonus depreciation, it can’t be used to generate a net operating loss.

When you think about the possibility of buying a new or used aircraft that costs $250,000, and being able to totally write it off in 2008, the cash flow numbers really become interesting. At a 35% tax rate, that’s a tax savings of $87,500. That will more than make the down payment and cover the note payments and operating expenses for a couple of years.

When you think about the possibility of buying a new or used aircraft that costs $250,000, and being able to totally write it off in 2008, the cash flow numbers really become interesting. At a 35% tax rate, that’s a tax savings of $87,500. That will more than make the down payment and cover the note payments and operating expenses for a couple of years.

If you want to get creative, and if everything will fit, consider what will happen with the $500,000 airplane referred to earlier if we put the bonus depreciation and the Section 179 depreciation together. Assuming this is a new airplane, the total first-year depreciation deduction could go as high as 80% or $400,000. Do the math on those deductions at 35%, and you’ll see that you can save $140,000 in tax in 2008.

These incentives aren’t just for the purchase of aircraft. These incentives also apply for modifications, refurbishments, improvements, and additions and replacements that are required to be capitalized. These incentives will therefore benefit the whole spectrum of aviation.

This is also a good time if you fly solely for fun and pleasure. You can buy a good used two- or four-seat personal aircraft without having to sell the house to do it. Although you may not intend to use your airplane for business and won’t benefit from the depreciation deductions, the interest rates on home-equity loans are pretty good right now, and there’s a good chance that you’ll get a tax deduction for the home-equity interest that you’re paying. This way, the bank is helping out with the purchase of the aircraft with good financing terms, and the IRS is helping out with the tax deductions on the interest you’re paying.

Interest rates are always chasing an ever-changing climate and economy. They’re subject to change daily based on the feeling of the Federal Reserve Board. So even though interest rates are low at this time, they’re, as always, subject to change. If you need some time to get your finances squared away, I think you’ll have some time in 2008. The depreciation incentives are only good through 2008, so once 2008 is over, so are the tax incentives.

So here we are. We have the manufacturers on board with product to sell, we have the banks on board with the money to loan and we have the government on board with the tax incentives. Is this a good time to buy a plane? You bet it is!

O. H. “Harry” Daniels Jr. is a CPA and a CFP licensee. He’s a partner with Duggan, Joiner & Company, Certified Public Accountants. Harry has held his license as a private pilot since 1991. E-mail him at [email protected].

| The Spring 2008 Airplane Market |

| How’s it doing? |

| By Barron Thomas |

| Airplanes are selling, financing is at all-time attractive rates and terms, the new tax write-offs for general aviation (GA) are the best tax incentives in its history, and prices have settled down from the peak of the real-estate boom. All in all, it’s a pretty good time to buy, and savvy pilots are taking advantage of this perfect storm of events. Advertisement

Most GA airplanes that are 1978-vintage and newer, and above $25,000 in value, can be financed for 20 years at fixed rates hovering around 7% (if you’ve got reasonably decent credit). Decent credit is normally defined as a credit score of 670 or better, in addition to a good income, which means you can prove that you’re able to feed your family, make house payments and still cover the airplane payment. Mathematically, lenders generally want to see a debt-to-income ratio of 45:100 (in plain English, your total monthly obligations, including airplane, don’t exceed 45% of your gross income). Cessna Finance, Air Fleet Capital, U.S. Aircraft Finance and Dorr Aviation are all eager to help you get the airplane of your dreams. They’re easy to work with and generally respond within 24 hours if you have your financials ready (your last two years’ tax returns and a completed credit application). Each lender has slightly different requirements for loan amounts and terms, and some are more creative than others when it comes to self-employed people who don’t show a lot of “taxable” income but can otherwise prove their assets/net worth and have a good credit rating. Airplane finance rates have never been this attractive, and today’s low rates will more than offset the higher fuel costs. Teri McGreevy of Cessna Finance (www.cfcloan.com) says, “Cessna normally wants to see deals of $100,000 and above, and will quote rate and terms on an individual, case-by-case basis.” Cessna’s regional reps are eager to assist prospective purchasers of all aircraft types. Bob Howe of Dorr Aviation (www.dorraviation.com) is quoting an average of 6.75% fixed for 20 years on loans of $50,000 and above. Dorr, like many lenders, has a $25,000 minimum loan amount. Howe adds, “Dorr is very close to rolling out a ’no doc’ plane loan program for borrowers with strong credit. Our lenders are looking for something more secure and safe than real estate right now, and they realize that GA is a stable market.” Air Fleet Capital (www.airfleetcapital.com) and U.S. Aircraft Finance (www.usaircraftfinance.com) offer competitive programs designed to get you quickly and easily into airplane ownership. The math works, so take advantage of these programs while they’re being offered. Advertisement

Insurance is still affordable and easy to obtain. Chuck Wenk and his two children run what may be the country’s largest and oldest aircraft insurance agency, Wenk Insurance (www.wenkinsurance.com). Wenk can provide aircraft insurance in every contiguous American state (at one time or another Wenk has even insured Jimmy Buffet and Oprah Winfrey). He confirms, “There’s been no lull in the market for insurance, and demand is still on par with the last several years. Although the economy has changed in reaction to real estate in some parts of the country, people are, by and large, keeping their planes, and rates haven’t really changed.” The newly signed Economic Stimulus Act includes a wonderful gift for GA. Everyone wants a plane, but sometimes an extra justification or nudge is needed. The liberal depreciation rules for 2008 are just the answer. GA tax credits have never been this good, but don’t delay, they’re expected to expire at the end of 2008. As always, consult your CPA for the details of how this will apply to your situation. Pricewise, it’s natural that nothing today is bringing what it did at the peak of the real-estate bubble (2005–2007). Historically, airplanes have proven to be a safe haven of value over the years, but they, like most assets, can ebb and flow with economic times. Boom times generally tighten the supply of airplanes and raise prices; economic slowdowns do the reverse. One of the true economic utilities of GA is that, unlike a house, an airplane can be moved to an area of the country that’s doing well. Proof that GA airplanes are a sound investment is the fact that financiers are offering 20-year terms on even airplanes built in the late 1970s. The recently soft U.S. dollar has a brought a wave of buying activity from around the world. GA airplanes are now being exported in numbers not seen since the mid-1980s. The good news for buyers is that there are a few more airplanes for sale than two years ago; so the selection is better and prices are more attractive. This may be the right time to buy. Bargain financing rates and generous gifts from Uncle Sam always make airplanes sell; a buyer who procrastinates or expects a “pie-in-the-sky” bargain may find that good deals and airplanes will soon be picked over. Advertisement

Flying is wonderful all by itself, and getting Uncle Sam’s “help” during the purchase process makes an airplane that much sweeter. It seems that changes in the economy haven’t impacted GA. Grab your calculator, do the math and buy an airplane! |